Mobile market shares

Mobile market shares in Switzerland

At the end of 2024, Swisscom had 6,331,000 mobile customers in Switzerland, up 0.9% or 54,000 compared to the previous year. It gained 110,000 new contract customers (postpaid plans) but lost 56,000 prepaid customers.

Sunrise recorded growth of 3.7% over the same period. This operator had 3,132,000 mobile customers at the end of 2024, having gained 159,000 postpaid customers yet lost 48,000 in the prepaid segment.

The number of Salt customers also increased, now standing at 2,120,000 (+7.2%). This operator added some 142,000 postpaid subscriptions during the year, plus 1,000 customers in the prepaid segment.

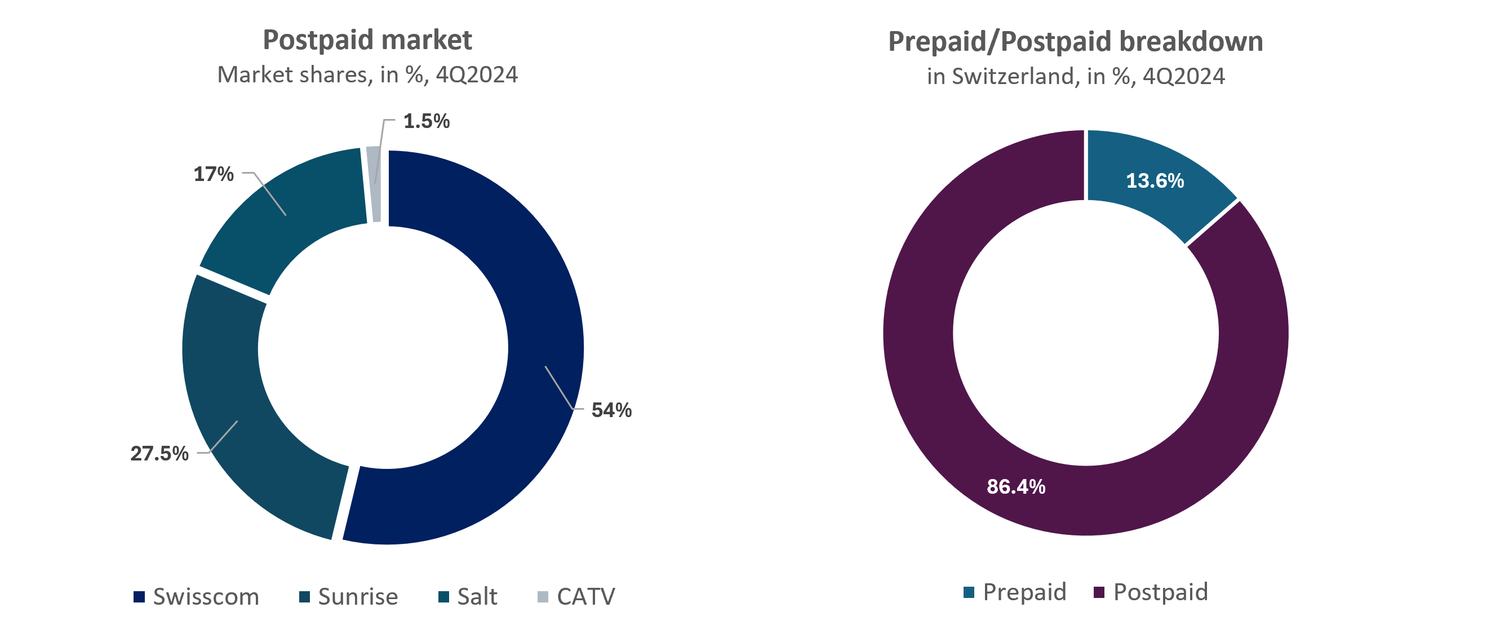

The data available to us indicates that Swisscom had a market share of around 54% at the end of 2024, while Sunrise had 26.5% and Salt 18%. Cable network operators (CATV) continue to account for just 1.5% of the market.

For over ten years now, the market dynamic has been driven largely by the contract segment. Users of prepaid offers have increasingly been switching to contracts, with the proportion of contract customers thus increasing from 59% in 2014 to almost 86.5% in 2024. The proportion of contract customers has continued to rise at each of the three network operators in recent months, and now stands at 89.6% at Sunrise, 86.2% at Swisscom and 82.3% at Salt.

Together, the operators gained more than 410,000 new postpaid customers in 2024. In this segment, Swisscom held some 54% of the market, Sunrise 27.5%, Salt 17% and CATV operators 1.5%.

* The method used to count their prepaid customers differs between operators: Sunrise uses the 3-month rule, while Swisscom and Salt use the 12-month rule. This method takes into account prepaid customers with an active SIM card who have made at least one inbound or outbound connection to the network in the last three or twelve months.