Fibre connections in Switzerland

Percentage of fibre connections in total fixed broadband

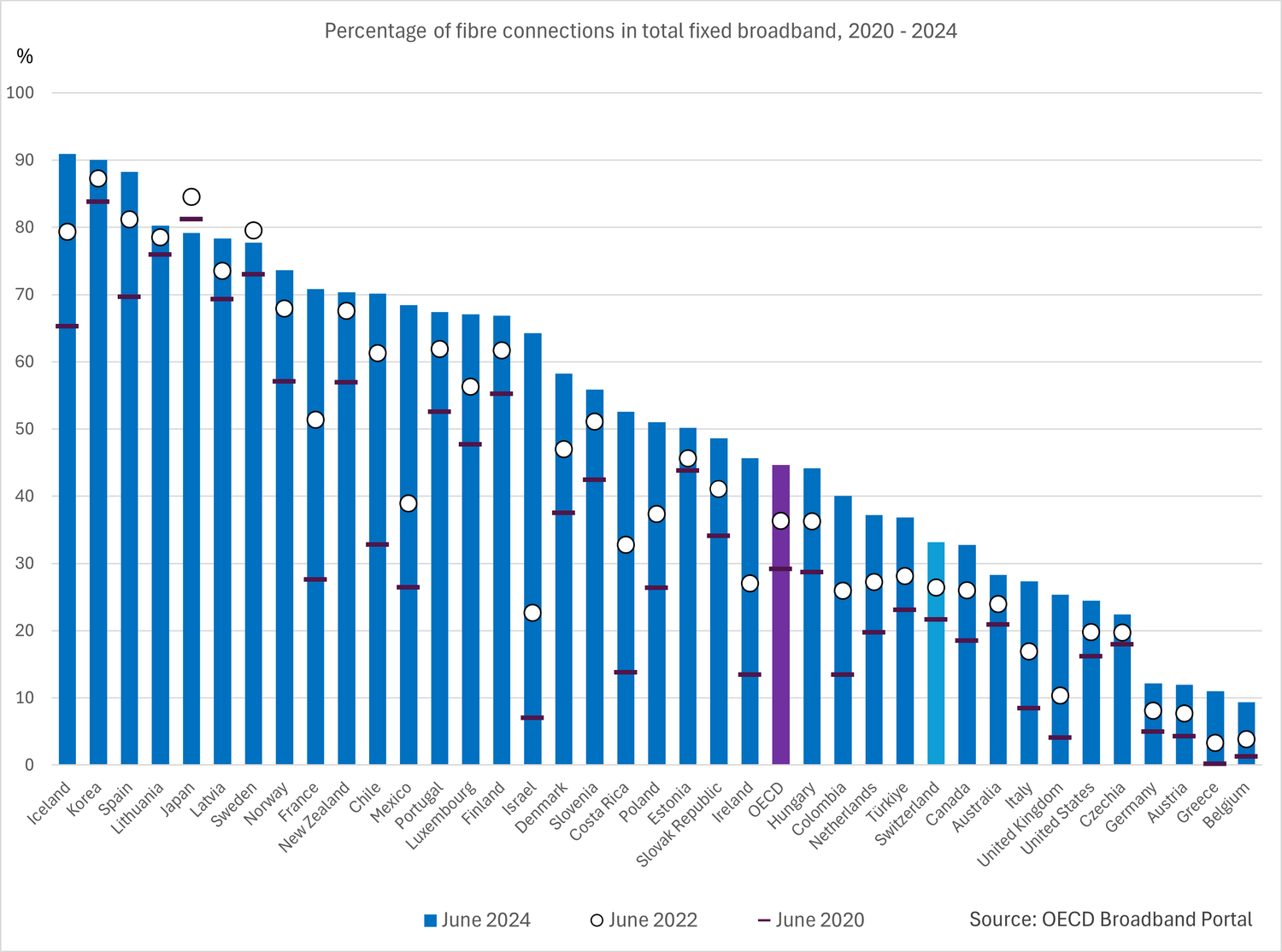

In contrast to its superior ranking in the provision of broadband services via hybrid fixed networks, Switzerland is not a world leader when it comes to fibre to the home (FTTH). But it has made up some ground over recent years: Switzerland now stands in the middle of the European field in terms of rollout and use of optical fibre connections.

Over several years, within a framework of co-operation between Swisscom and local utility providers, FTTH networks have been constructed in numerous cities and regions. In other locations, individual political municipalities are going it alone with investment in FTTH. In addition to cooperation, Swisscom is also currently working alone on investments to modernise the fixed network in many locations. Numerous CATV operators also have constantly invested in fibre expansion.

Swiss Fibre Net (SFN), which joined the market in 2013, is also stimulating competition. SFN is a network consortium consisting of numerous utility providers which have constructed local fibre networks, offers service providers who do not have their own access network (e.g. Init7, 1tv, iWay.ch, GGA Maur, Salt, Sunrise and VTX) the possibility of sourcing uniform FTTH products nationwide via a common platform for resale.

Swiss4net is another company that is investing in the construction and operation of local optical fibre networks. Swiss4net is planning, constructing and financing FTTH networks based on P2P architecture in communes and cities where they can lease the duct installations required from the commune or energy provider. Swiss4net now has at least eight local optical fibre networks (e.g. in Morges, Pully, Chiasso, Ascona, Baden and Wettingen). Various telecom providers deliver their services via the networks operated by Swiss4net.

As far as subscriptions are concerned, we note that the number of domestic fibre-optic contracts (FTTH/B) in Switzerland is gradually increasing, with the broadband market almost saturated at around 4.25 million connections. Growth of the fibre-optic segment is primarily the result of DSL and CATV subscribers migrating to fibre optic technology. At the end of 2024, the estimated number of fibre-optic connections amounted to around 32% of total broadband connections in Switzerland, or around 1.4 million.

In international comparison, the growth in fibre-optic contracts in Switzerland (+16.3% between June 2023 and June 2024) is higher than the corresponding OECD average (+11.7%) and that of some of its neighbours, France (+16%) and Austria (+14.9%), but lower than Italy which recorded growth of 26.3% and Germany (+22.3%).

However, with a rate of 32%, Switzerland still lags behind the OECD average, where the fibre-optic penetration in broadband was over 44.6% in mid-2024. Although Switzerland is better positioned than most neighbouring countries, such as Italy (27.3%), Germany (12.2%) and Austria (12%), only France has a high share of fibre-optic contracts (70.9%).