Digital TV

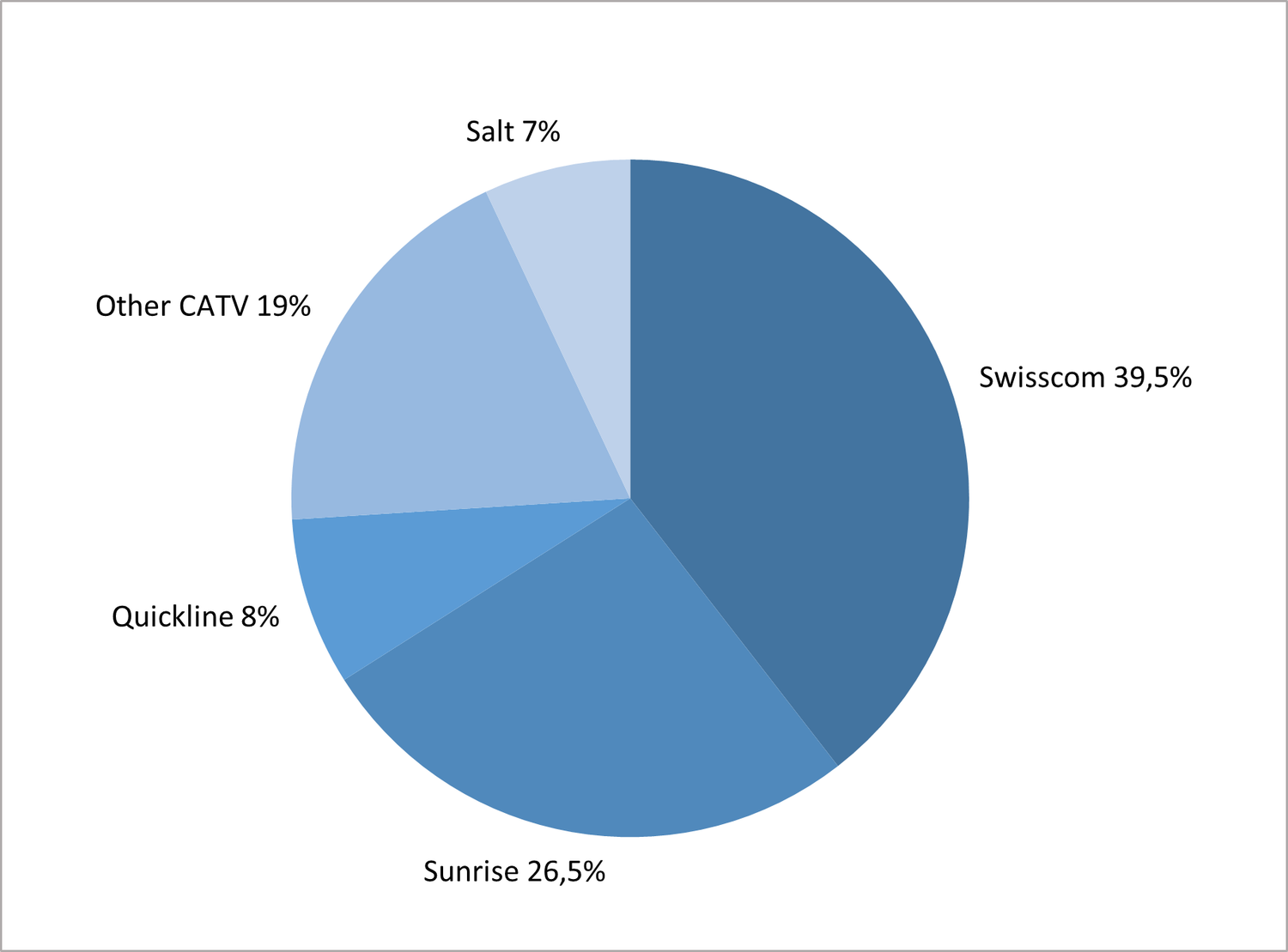

Digital TV market share in Switzerland

The market for digital television is evolving under the pressure from streaming platforms and consumers’ changing habits.

The telecommunications providers active in the digital TV market are facing growing competition because there are more and more players with combined broadband/phone/TV offers and also more and more offers from streaming platforms.

Against this particular background, the telecom providers have witnessed a decline in TV customer numbers over a number of years. Between 2023 and 2024, this decline was 40,000 customers (-1%).

The Sunrise/UPC merger in 2021 changed the balance of power between the main players in this market segment, although it has yet to have a significant impact on the market structure. Sunrise was able to maintain its customer numbers and market share at the 2021 level, while Swisscom lost 1.5 percentage points over the same period. On the other hand, Salt – the last company to enter the broadband internet and fixed network TV market, in 2021 – was the only operator to record significant growth, with an increase of more than 2.5 percentage points over the same period.

With just over 2 million digital television customers, CATV operators remain the market leaders in Switzerland with a market share of around 53%, even though they are steadily losing customers in their core business, recording a loss of 36,000 customers in 2024, a decline of 1.8%.

But considering the providers individually, Swisscom was able to maintain its leading position even in the difficult economic situation. Despite losing 44,000 customers in 2024 (-2.9%), Swisscom still had almost 1.5 million digital TV subscribers; by the end of 2024, its market share had fallen slightly to 39.5%.

During the same period, Sunrise (including UPC) gained around 1500 customers (+0.1%) and was able to maintain its market share of 26.5%. Quickline, the association of several CATV operators, has seen a slight upturn in the number of its TV customers (+800 or +0.3%). With just over 300,000 customers at the end of 2024, Quickline’s market share remained consistent at around 8%. The market share of the other CATV operators reached about 19% and that of Salt, which gained more than 42,000 customers in 2024 (+19%), increased to 7%.